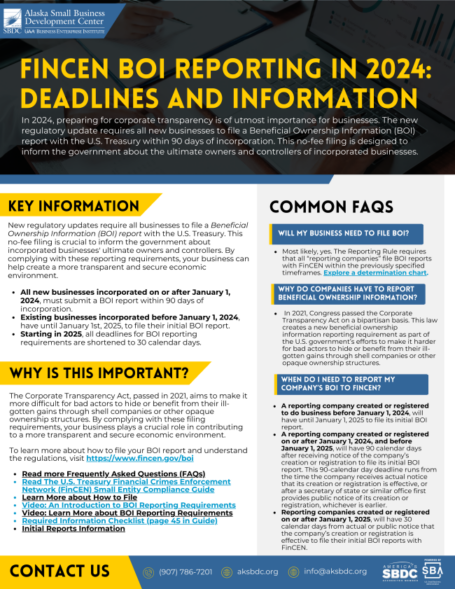

In 2024, preparing for corporate transparency is of utmost importance for businesses.

In 2024, preparing for corporate transparency is of utmost importance for businesses.

The new regulatory update requires all new businesses to file a Beneficial Ownership Information (BOI) report with the U.S. Treasury within 90 days of incorporation. This no-fee filing is designed to inform the government about incorporated businesses’ ultimate owners and controllers.

The Corporate Transparency Act, passed in 2021, aims to make it more difficult for bad actors to hide or benefit from their ill-gotten gains through opaque ownership structures or shell companies. By complying with the reporting requirements, businesses can contribute to a more transparent and secure economic environment.